- September 23, 2021

- Mahesh Kalluri

- BANKRUPTCYcitationsDRThandyyhighcourtINSOLVENCYNCLTsupremecourtTRIBUNALS

Insolvency & Bankruptcy Code 2016

When it comes to debt, the phrases insolvency and bankruptcy are sometimes used interchangeably. They have quite distinct connotations, though. Bankruptcy is a legal procedure, whereas insolvency is a financial position.

The Insolvency and Bankruptcy Code, 2016 (IBC) is India’s bankruptcy law, which aims to unify the existing framework by establishing a single insolvency and bankruptcy law. The bankruptcy code is a one-stop shop for resolving insolvencies, which was formerly a time-consuming process with no economically acceptable remedy. The code strives to protect small investors’ interests while also making the business process easier. There are 255 sections and 11 schedules in the IBC.

Silent Features

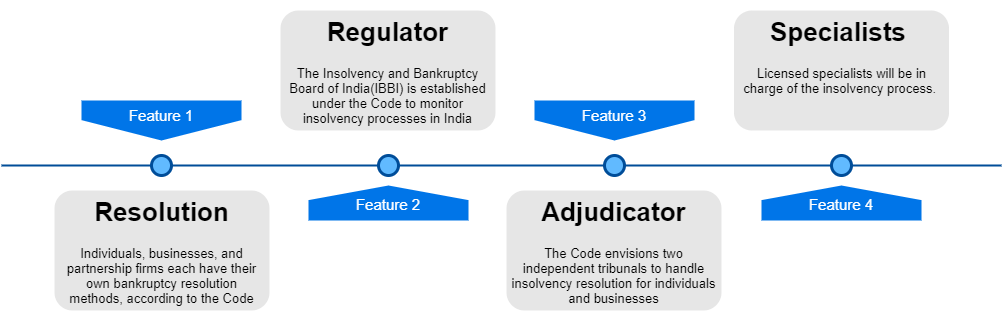

Resolution

Individuals, businesses, and partnership firms each have their own bankruptcy resolution methods, according to the Code. Either the debtor or the creditors can start the process. For corporations and individuals, a maximum time restriction for completing the insolvency resolution process has been set. Companies will have 180 days to finish the process, which can be extended by 90 days if a majority of creditors agree. The resolution procedure for start-ups (other than partnership firms), small businesses, and other businesses (with assets less than Rs. 1 crore) would be completed within 90 days of the request’s initiation, with the possibility of a 45-day extension.

Regulator

The Insolvency and Bankruptcy Board of India(IBBI) is established under the Code to monitor insolvency processes in India and to govern the organizations registered under it. The Board will be made up of ten members, including representatives from the Finance and Law Ministries, as well as the Reserve Bank of India.

Adjudicator

The Code envisions two independent tribunals to handle insolvency resolution for individuals and businesses: I The National Company Law Tribunal (NCLT) for corporations and indebtedness partnership organizations; and (ii) the Debt Recovery Tribunal (DRT) for individuals and partnerships.

Specialists

Licensed specialists will be in charge of the insolvency process. During the insolvency procedure, these professionals will also be in charge of the debtor’s assets.

The IBC appoints 2 completely different authorities to create the procedure for financial condition resolution smoother. The National Company Law Tribunal(NCLT) to affect cases regarding corporations and LLP’s and therefore the Debt Recovery Tribunal (DRT) for partnership corporations and individual.

Process For Filing

Financial or commercial creditors or the corporate debtor himself file a bankruptcy application with the competent authority (NCLT for corporate debtors). The maximum period to accept or reject the objection is 14 days. If the objection is upheld, the arbitral tribunal must commission a Provisional Resolution Professional (PIR) to develop a resolution plan within 180 days (extendable by 90 days). Then the judicial process begins to dissolve the insolvency of the company. During this period, the company’s board of directors is suspended and the promoters have no say in the management of the company. If necessary, the IRP can call on the support of company management in day-to-day business activities. If the CIRP fails to reactivate the company, the liquidation process begins.

P.S. The Drafts for filing Insolvency & Bankruptcy can be found in HANDYY Drafts Library

Adisri

It is very useful article by you sir.